Rolls-Royce share price pulled back this week, moving to a low of 966p, down from the year-to-date high of 1,011p. It has jumped by 70% this year, beating the FTSE 100 Index and most of its constituent companies. Its stock has jumped by over 2,733% from its lowest level during the pandemic.

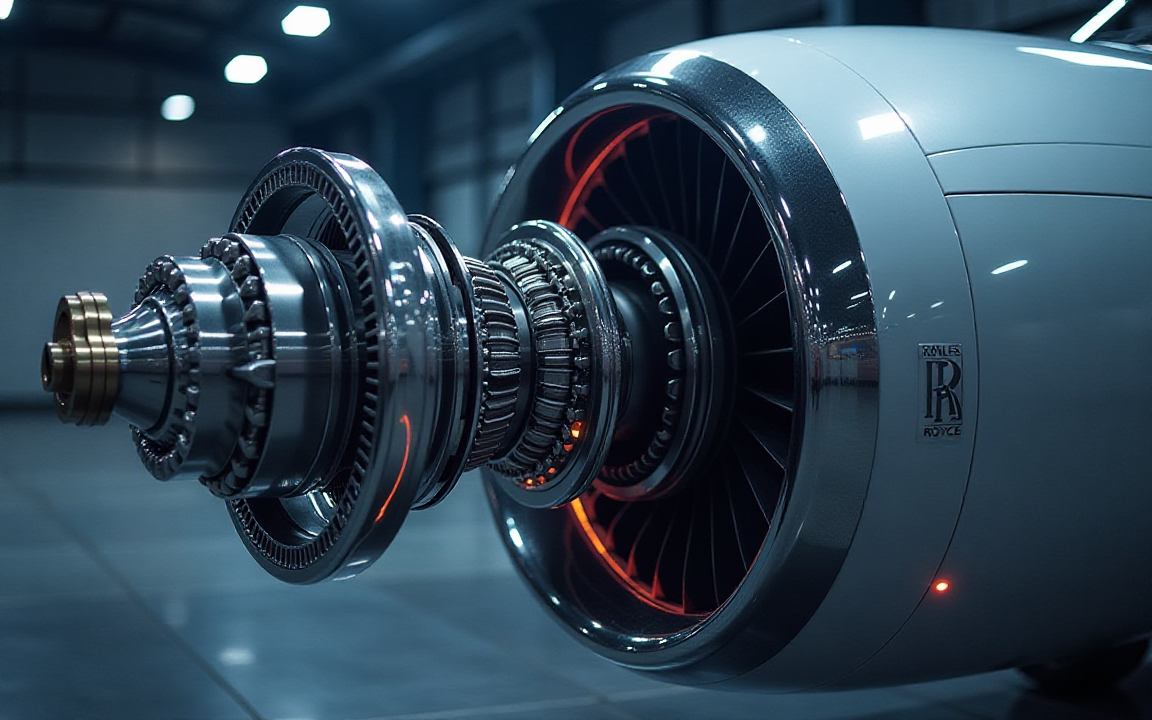

Rolls-Royce Holdings is firing on all cylinders

Rolls-Royce Holdings, one of the largest players in the manufacturing industry, has been on a strong bull run over the past few years. This growth is mostly because of the rising demand in three of its markets: civil aviation, power, and defense.

There are signs that the civil aviation industry is thriving this year as recent data showed that most airlines were back to their pre-pandemic levels. Indeed, companies like United Airlines, Delta, and American have all published strong results recently.

Many airlines have also made huge purchase orders, with Airbus having a backlog of over 8,500 and Boeing’s approaching 6,000. This growth explains why GE Aerospace, the biggest player in the engine industry, published strong results last week.

Its results showed that the second-quarter revenue jumped by 21% to $11 billion. It also raised the full-year 2025 and 2028 guidance in which it hopes to achieve an operating profit of $11.5 billion and free cash flow in 2028.

These numbers were $1.5 billion higher than what it promised during its investor day. It also boosted is shareholder returns, pledging to give them about 70% of its free cash flow through dividends and buybacks.

Therefore, it is likely that Rolls-Royce will also publish strong results and even boost its guidance in the coming results. Besides, the two are in largely the same industries, and its performance is a sign of the growing demand.

Energy manufacturing demand is rising

Rolls-Royce share price is also doing well as other similar companies in the power engine manufacturing business thrive. Its power business manufactures high-and medium-speed engine, equipment for microgrids, and engines for ships.

Siemens Energy share price has jumped this year and is one of the top gainers in the DAX Index, while GE Vernova has soared this year.

This growth is likely to continue as demand for power increases across the developed world due to the artificial intelligence boom. This segment has a book-to-bill ratio of 1.5x.

The same is happening in its defense business, which is seeing more demand across its portfolio.

Therefore, it is likely that Rolls-Royce will publish strong results on July 31st. In its latest trading statement, the company maintained its guidance for the year, with operating profit expected to be between £2.7 billion and £2.9 billion.

The Rolls-Royce share price will also react to a meeting between EU and Chinese officials, which is expected to result in hundreds of Airbus orders.

Rolls-Royce share price analysis

The daily chart shows that the Rolls-Royce stock price has been in a strong bull run in the past few years. It pumped from a low of 557p in April to a high of 1,013p.

The stock has formed an ascending channel that connects the highest and lowest levels since April 15. It has remained above the 50-day and 100-day moving averages.

The Rolls-Royce stock price will likely continue rising as bulls target the key resistance point at 1,013p. A move above that level will point to more gains, potentially to the next psychological point 1,100p.

A move below the lower side of the channel will indicate further downside, potentially to 900p. This bearish view is supported by the fact that the MACD and the Relative Strength Index (RSI) have formed a bearish divergence pattern.

The post Rolls-Royce share price drops: July 31 will be crucial appeared first on Invezz